Oscillator

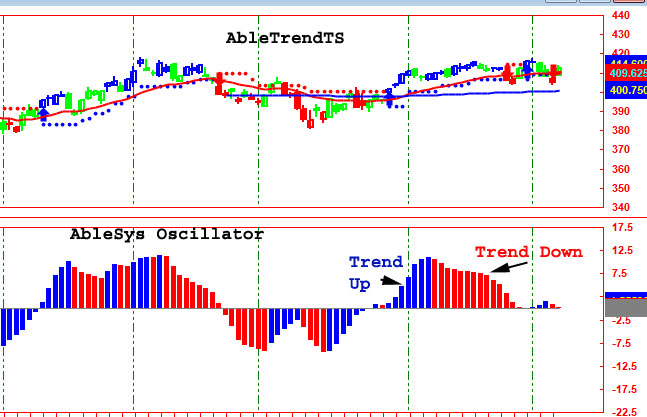

Oscillator is built from MACD modifications for monitor of market directions. AbleTrend takes care of big trend directions, and the Oscillator watches trend in more details.

Default settings:

Fast length is 5.

Slow length is 21.

Usage:

Basically, the positive values mean Uptrend, and the negative value Downtrend. The AbleTrend oscillator is either blue for Uptrend or red for a Downtrend and it's at the bottom of the chart.

The AbleTrend oscillator is helpful to know when to get back into a trade after you have been stopped out for day trading. And, it helps to exit your trade quickly.

Day trading with 1-2-3 guidance chart, if stopped out when day trading then you may re-enter on a sweet spot which is when the price pulls back to the small blue or small red dots and then the next red or blue price bar with agreement from the 1, 2 and 3 minute signal also - meaning there is also a 2min “x" and a 3min arrow of the same color and also the oscillator is the same color as the price bar. That puts the odds of success in your favor and lowers risk. You watch the Oscillator still remaining on the same direction or not under sideways.

Developed by Gerald Appel, Moving Average Convergence Divergence (MACD) is one of the simplest and most reliable indicators available. Moving Averages are trend-following indicators that don’t work well in choppy markets. Oscillators tend to be more responsive to the choppy markets. MACD indicator combines trend and choppy characteristics. MACD basically is still a trend-following indicator.

Calculations

MACD = EMA1 – EMA2

Where,

MACD - Value of Moving Average Convergence Divergence

EMA1 – Fast Exponential Moving Average

EMA2 – Slow Exponential Moving Average

Price value is Close

Length of EMA1 is 12

Length of EMA2 is 26

Note: MACD does not support such histogram format. An error message will show. After add a MACD, please make sure all plots type is Line.