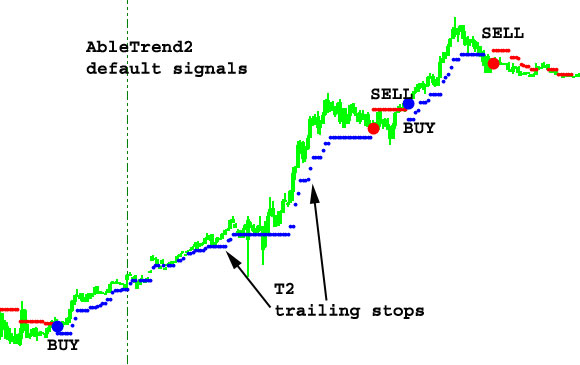

AbleTrend2 (AT2) and AbleTrend3 (AT3) are trend-stop indicators, and are demonstrated by BLUE DOTS and RED DOTS. For distinguishing purposes, AbleTrend2 uses Cyan (light blue) and Magenta (pink) dots, and AbleTrend3 uses Blue and Red dots. Both AbleTrend2 and AbleTrend3 must identify a trend first then begin to paint the dots. This is why you may not see any blue or red dots sometimes.

BLUE DOTS below the lows of the bars indicate two things: (1) the market is in an up-trend; (2) the values of the BLUE dots are the protection stops or the profit target stops (if the position had profit) for the long position. The value of the BLUE points can be seen in the Data Window. Click Tools menu, then click Info Window. The Info Window will appear on the screen. You may also use the Inf icon from the toolbar to pop up this Info Window. Click a bar, look for the BuyStop2 value in the Info window if you use AbleTrend2. Look for the BuyStop3 value in the Info window if you use AbleTrend3.

The RED DOTS above the highs of the bars indicate two things: (1) the market is in a down-trend; (2) the values of the RED DOTS are the protection stops or the profit target stops (if the position had profit) for the short position. The values of the RED points can be seen in the Info Window. Look for the SellStop2 value in the Info Window if you use AbleTrend2. Look for the SellStop3 value in the Info window if you use AbleTrend3.

Many studies reveal that it is more difficult to know how to exit the market than to enter the market. One can get into the market at any time if one knows how to get out of the market. AbleTrend2 and AbleTrend3 are TREND-Stops indicators which are precisely and objectively defined by the market’s own prices. They help traders enter and stay in the right market direction with minimal risk. You can back test Trend-STOPS with the historical data. AbleTrend2 and AbleTrend3 work in very similar ways, but the trend definition and stop calculations are different. AbleTrend3 is about 50% more sensitive than AbleTrend2. Use AbleTrend3 to enter the market, use AbleTrend2 as trailing stops.

The beauty of AbleTrend (AT) stops is that the stops change along with the market. The stop values are determined by the market’s prices objectively. When you enter the market, the stops will continuously indicate the optimal stops guiding you to lock in your profit, and to approach maximum profits step by step.

A new concept of range is used in this version to define the best stops. AT now can dynamically adjust its internal settings according to the market moves. Default values of the inputs should be your first choice. With new version of AT, the TSPC and MONYRISK settings become less important. However, you still can change the settings to best fit your personal risk level.

RISK and MONYRISK are two inputs of the trend-stop indicators. Click "An" icon, then click "Format Indicator" button, or From Format, Indicator menu, you can see three "Parameters" for AbleTrend2 and AbleTrend3. You can change RISK and MONYRISK by changing parameter values..

AbleTrend provides flexibility. "RISK" factor for both AbleTrend2 and AbleTrend3 can be adjusted from 1 to 20, "1" is the most sensitive with minimum delay and "20" is the least sensitive. The default value of RISK is 3..

MONYRISK is an optional input for AbleTrend2 and AbleTrend3. This option affects the trend-stop values only, it does not affects the trend determination. A specific range unit for MONYRISK is used here. This unit varies with the volatility of the markets and is defined by market movement. When you change this input value, you have choice to enlarge or reduce the stops. The amount of money risky for different markets varies. For example, MONYRISK 1.0 for common stocks means $1.00 per share; MONYRISK 1.0 for S&P 500 futures means $250 per contract; MONYRISK 1.0 for currencies means $125,000 per contract and MONYRISK 1.0 for T-Bonds means $1000 per contract…

Why use this specific unit? Because it replaces "Symbol Universe Settings". There are over 25,000 security symbols in the U.S. alone. It is hard to check and setup each symbol universe accurately and individually. Further more, when you use third party data, different data venders use different symbol names and different units for the same security. Symbol Universe Settings become very complicated.

The MONYRISK factor would be applied to AbleTrend calculations only when the LONG or SHORT positions had profits. When profit is greater than the MONYRISK unit set, extra protection for the profit will be activated automatically. AbleTrend2 or AbleTrend3 TREND-STOPS will start to tighten the stops. It will also affect the calculations for the low risk entry points. The default value of MONYRISK is 1.50 for AbleTrend3 and 2.0 for AbleTrend2 respectively. In another words, after the profit for the position become greater than 1.50 times the average market movement, AbleTrend will begin to tighten stops. MONYRISK can be adjusted from 0.5 to 5.0. If you like to use the Fibonacci number, you may use them as inputs, such as: 0.382, 0.618, 1.000, 1.382, 1.618, 2.000, 2.382, 2.618…

If you do not want this option at all, simply input a big number, such as 1,000,000. Under this 1,000,000 unit setting, AbleTrend2 or AbleTrend3 will only follow the market own price projection to decide the stops.

ASCMODE is a signal option. There is only one signal mode in AbleTrend2. Therefore, it has no ASCMODE for AbleTrend2. There are two signal modes for AbleTrend3. The default ASCMODE for AbleTrend3 is 1.

Default of AbleTrend2

ASCMODE 0

RISK 3

MONYRISK 2