Powerful Tool for Cultivating Winning Traders

Four Essential Characters of Traders/Investors

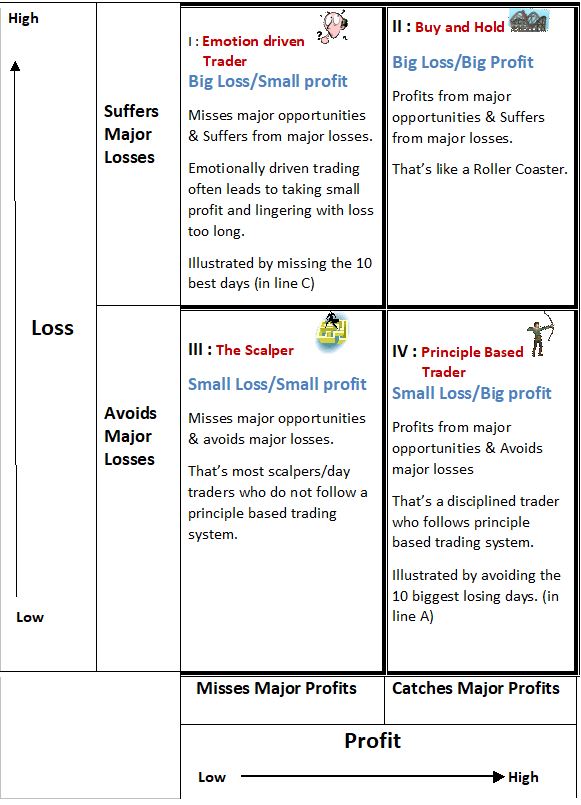

The essential characters of traders/investors can be captured in the profit/loss matrix diagrammed as below. Basically, we belong to one of the characters.

Profit/Loss Matrix

The two factors that define a character or trader are profit and loss. Quadrant I character tends to take the small profit and run because of fear of losing. Without the assistance of a principle based system and trader’s confidence with the system, taking a small profit and then run is the most natural and common mistake which is hard to avoid. For the losing trades on the other hand the Quadrant I character tends to linger with the position hoping the market will soon turn around to his favor. They do not know if the market had changed direction or not so they began to pray. Many times, the market kept going against him and he needed to know how far is too far before getting into serious problem. When traders or investors are holding a position, market impulses could drive them to become less objective. Some of them even cannot pull the trigger to take the stops till getting the margin calls if they trade futures. A trader told me that his biggest problems were getting out too quick on the winning trades and staying way too long in the losing trades. This is a common problem that quadrant I traders face.

Quadrant II is Buy and Hold. Investors holding long term positions through the Dot.Com Bubble understand that markets could wash away a large portion of the profit in a very short period of time and took a long time to recover if they ever could.

Quadrant III is the scalper who does day trading without following the principle based trading system. Taking small profits and small losses could end up with a net loss after paying commissions.

Quadrant IV is the principle based trader. He follows the market with his time-proven trading system. The market can be chaotic and unpredictable but his way of trading is simply following the market with calculated risks.

He spends time studying and practicing his principle based system well and builds a strong confidence with the system he uses; for every position he takes he knows exactly where the true market support and resistance levels are and taking well calculated risk for each position he takes so that he is able to take full advantage of the market rally and stay aside when the market is trending down. Perhaps he shorts the market if he trades the futures. He uses his universal trading system to find wherever money is and simply follow the market.

Obviously our objective is to be the ‘principle based trader, nailing the market moves and making a lot of money but so many of traders can be exhibited characteristics from Quadrant 1 and Quadrant 3. Only by identifying one’s own tendencies can he or she begin to find the cures.

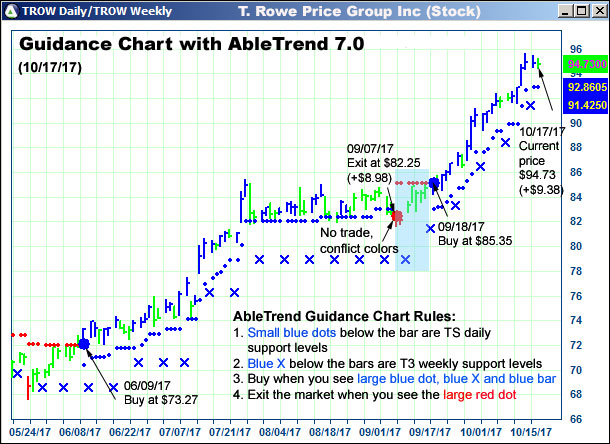

AbleTrend is time proven principle based trading system. Here are examples of the recent stock charts.

As you can see, AbleTrend support level indicator sends safety precaution with a red dot when market breaks the support level so that you are always well informed with the market situation and you will be able to take high probability trades only and stay away from the higher risk trades.

The best way to learn a skill is by practicing it. Through guides and tutorials, we will help you prepare for actual trading on the live market so you`ll know how your psychology will react to the experience. This insight is gained only through experience so give AbleTrend a try today.

View AbleSys YouTube

As always, please feel free to forward this email to your friends.

With Warm Regards

AbleSys Corp.

Grace Wang

gracew@ablesys.com

Leave a Reply

You must be logged in to post a comment.