Trade Setups for Big Market Moves (2)

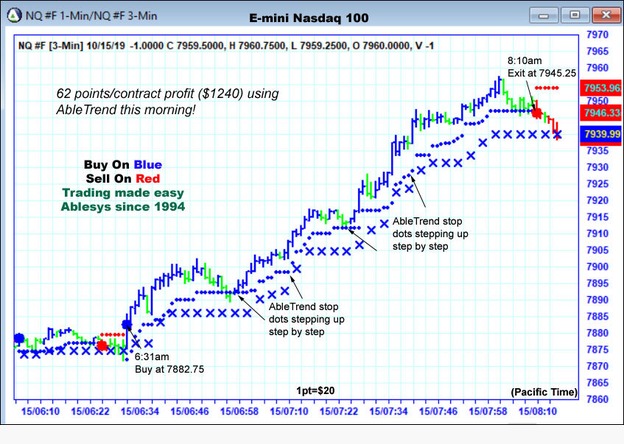

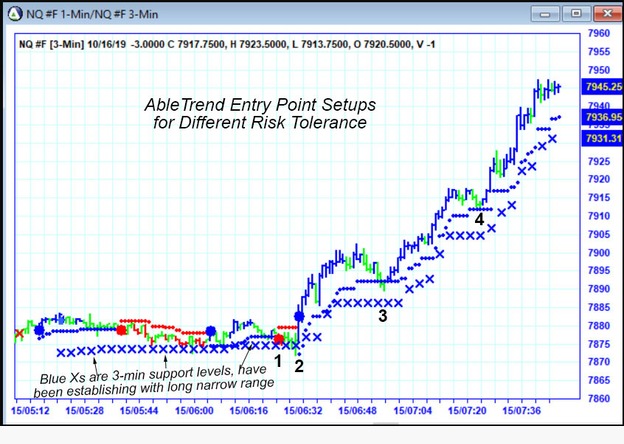

AbleTrend is robust, flexible and can be used by traders with different risk tolerance levels. Here is the big move of yesterday’s E-mini NQ market.

The move

The Setups

Setup for entry point 1 in the above chart:

1. AbleTrend blue Xs have been established showing the uptrend has been forming.

2. 1-minute Red bars are market pull backs to test the blue X, which are 3-minute support levels.

3. Buy at point 1 as red bar turns green.

4. Since the 1-minute bar just turn from red to green, you take some uncertainty for the smaller time frame, but you are in agreement with the longer time frame (3-minute direction). Your stop to the 3-minute support is closer.

Setup for entry point 2 in the above chart:

1. Buy at AbleTrend buy signal.

2. It’s more curtain that the uptrend is on the way

3. The Stop will be larger than the stop for entry point 1.

Setup for entry point 3 and 4 in the above chart:

1. This is a sweet spot after the buy signal

2. It adds some certainty for the uptrend and you enter after pull back with green bar.

The New Micro E-mini Futures for New Traders

ECM has introduced the new Micro E-mini Futures. At 1/10th the size of a classic E-mini contract, Micro E-minis require less cash to enter the market with lower margins. This new instrument has made it possible for individual traders to take advantage of the market volatility with lower risk.

Here is a 7-minute video

showing you how to systematically identify sweet spot and significantly improve your trading result.

The best way to learn a skill is by practicing it. Through guides and tutorials, we will help you prepare for actual trading on the live market so you`ll know how your psychology will react to the experience. This insight is gained only through experience so give AbleTrend a try today.

Get a trial with hands-holding one-on-one consultant today.$30 OFF discount code: DTHS69

Learn more with 2-min video Introduction to AbleTrend.

With Warm Regards,

Grace Wang

AbleSys Corp.

grace@ablesys.com

Trading Futures and Options involves substantial risk. It is not suitable for all investors.

*HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS. STAFFORD TRADING HAS HAD NO EXPERIENCE IN TRADING ACTUAL ACCOUNTS ON THIS SYSTEM. BECAUSE THERE ARE NO ACTUAL TRADING RESULTS TO COMPARE TO THE HYPOTHETICAL PERFORMANCE RESULTS, CUSTOMERS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THESE HYPOTHETICAL PERFORMANCE RESULTS. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

Leave a Reply

You must be logged in to post a comment.